|

he next few weeks are arguably the most important period of time in the life of an entrepreneur or manager. It's goal-setting season! In the next two weeks leading up to the New Year, and likely for a few weeks heading into 2021, you'll spend tens of hours defining your 2021 goals with your team. Invest this time wisely and set yourself up for success in 2021 by setting aligned SMART goals. If you're anything like millions of other leaders around the world, the format you'll use SMART (specific, measurable, assignable, realistic, time-based). Fundamentally, this is a great approach. Here are three questions you ask yourself as you define your goals:

There are many naysayers and countless articles explaining why SMART goals don't work, but I'm here to tell you that they're wrong. There's a reason why the SMART goal format has been the go-to for results-oriented leaders for the past 40 years. If it ain't broke, don't fix it. As tempting as it is to be a little contrarian toward SMART goals, when I look back on my career in corporate America and the results I delivered, I achieved what I did in large part because of SMART goals. Every time, and I do mean every time, that I truly invested in defining high-quality goals with my team, where expectations were clear and progress toward these goals was measured and evaluated at least every few weeks, the target results were achieved. In the cases where goals were SMART and aligned, the results were off the charts. If you're aiming for great and not just good enough, and value an engaged team to drive results, read on. With just one small adjustment, you can make SMART goals much more meaningful, likely (and easier) to be achieved, and emotionally engaging. By aligning goals, the potential exists to drive a far better result than would otherwise be achieved by just conforming to the SMART goal format. The problem with SMART goals The general structure of SMART goals is excellent. First devised by George Doran in the early 1980's in response to the question, "how do you write meaningful objectives", he defined SMART criteria as follows: Specific - what will be accomplished? Measurable - how will the goal be measured and what are the criteria for success? Assignable - who owns the goal and will be held accountable for the result? Realistic - what extra resources are needed to accomplish the goal? There should be some stretch in the goal, but it shouldn't be a moonshot. Timely - what is the time period for the goal? What are the milestone dates and when will progress be assessed? Thus far in my life, I've spent hundreds of hours defining SMART goals for me and my team, and personal goals for me and my family, and the simple fact is that SMART goals consistently work when targeting a short-term specific goal. What I've observed is that when goals are simple and clearly defined and people are held accountable for their results, (while managers play offence and remove any roadblocks in their way), businesses thrive. But as good as they are, there a few notable blind spots with SMART goals you should be aware of:

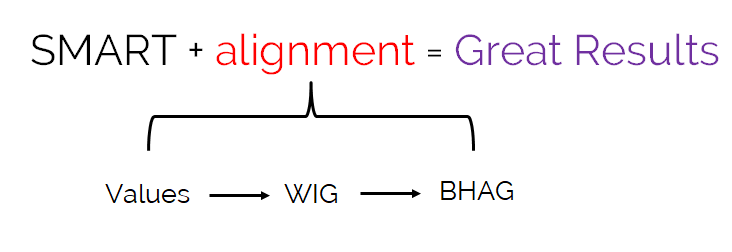

For more information about SMART goal setting (including a template), here's a link to some info that can help. SMART(er) goals through alignment SMART goals are great. Aligned SMART goals are even better. When you include the step of confirming alignment to your (or a team member's) personal and professional values, your Wildly Important Goal (WIG), and your Big Hairy Audacious Goal (BHAG), great results are more likely to follow. These three factors of alignment are detailed in the following sections. Alignment: Values

Your values dictate how you live your life and run your business. The outcome of your decisions - and goals - are all a result of how your values guide you. When your goals are more closely aligned to values, good things happen. And while it's possible to have a mismatch, doing so often leads to missed goals, frustration, and burnout. For example, in 2021 you may have a goal to grow your business by 20%, which means more time and money invested in your business. But your personal values of family harmony and child development are getting in the way. You want to grow your business, but need to make sure your kids get the learning and support they need as we enter into year two of Covid-19. Something's gotta give - either adjust your goals or (less likely to be successful), reassess your personal values. Alignment of your goals and values engages you and your team with higher levels of emotional buy-in, commitment, and motivation to the challenges ahead. For help defining your personal and professional values, here's a tool that can help. Alignment: WIG Your WIG (copyright Franklin Covey) is your "most important objective that won't be achieved unless it gets special attention" and "failure to achieve this goal will render all other achievements secondary." As I've used it, a WIG is a very specific, customer focused, SMART goal. This is the one thing, that when done really, really well, can have a profound impact on your business. When leading the team at a heavy equipment dealership, the WIG that led to great improvements in profitability and market share was customer response time, measured and reviewed daily. Our thinking? If we delivered on this WIG (which we did), results would follow (which they did). For help defining your WIG, here's a tool that can help. Alignment: BHAG Your BHAG (copyright Jim Collins) is an "emotional tool"…"a moon shot." This is the mountain you want your business to climb. This goal completes your mission and even though incorporates a great deal of stretch, is achievable if you stick to your values, WIG, and strategy. For help defining your BHAG, here's a tool that can help. How Values, WIG and BHAG fit together Your values define how you want to run your business. Your WIG defines what is most important to drive results. Your BHAG is where you want to go. All three need to be aligned with your SMART goals to drive short-term results and long-term success. When checking for alignment, ask these 3 questions

It is more than just possible to achieve an outrageous goal, with an engaged and happy team, when you are all aligned. Get out of the 2020 funk and step up your goal-setting game in 2021 with aligned SMART goals. --- PS - here are a few of the tips I jotted down for myself over the years to set better SMART goals:

2 Comments

My costs were sunk - what's one more year?

It's funny how certain memories burn themselves into your psyche. I remember one Christmas Eve so vividly. It was a cold and clear night in outport Newfoundland and I was about 7 years old. I was walking with my parents and little sister to a neighbor's house and had just finished watching Karl Wells on CBC TV where he convincingly described to his viewers how Santa had just received clearance from the Gander airport to deliver presents across Newfoundland. Of course, as a rational 7 year old (or as rational as anyone could be at that age), I thought that Karl was stretching the truth more than just a little. But as I looked up at the sky that night and - I kid you not - saw a shooting star streak out of sight over the looming basalt cliff behind my childhood home, I was willing to let my rationality slide for one more year. To my kids, the sunk cost is worth it My kids still believe in Santa Claus. My daughter, who is 8, is even more rational and logical than I was at her age, yet she is still outwardly committed to the idea that Santa and his reindeer are the real deal. She is a rarity. For those kids living in countries where Santa Claus mythology is an oral tradition, they usually stop believing somewhere between 6 and 8 years old. In reality, I know the gig has long been up for my daughter and her belief in Père Noël. My wife and I teach our kids to be critical thinkers and when my little girl eventually asks me directly if Santa is real, I'll respond truthfully. I think she's known Santa isn't real for at least a couple of years but isn't ready to give up her belief in Santa (or other fantastical beings like the Easter Bunny or Tooth Fairy) just yet. Why keep up the charade? If her rational self is telling her that Santa and his flying reindeer defy what she knows to be true and logical, why still believe? Because at this point in her childhood, she has more to lose than gain once her belief is busted. She's invested a tremendous amount of energy and love into the idea of this altruistic and mysterious being and isn't about to give that up cold turkey. And therein lies the reason - investment. Continued belief in Santa Claus, long past an age where doubt has already crept in, is a great example of where a sunk cost can influence a decision, and that's not a bad thing. In my last article I wrote about how sunk costs and the corresponding behavior of loss aversion can pollute decision making. However, I neglected to mention that there are situations where consideration of sunk costs are most definitely worth it - like believing in Santa Claus! When sunk costs are worth it - cut Santa some slack It's easy to take a hard line with sunk costs and how they should never impact your decision making, but it's not always that simple. Here are three situations to consider when sunk costs should influence how you make decisions: 1. When your value or belief system is involved Your values dictate how you live your life and run your business. The outcome of your decisions - and goals - are all a result of how your values guide you. At the end of the day, you have to live with and own every decision you make. If you are a leader who has guided your company to invest in environmental stewardship initiatives, only to see changes to the tax code greatly negate any financial benefit, do you ignore your values and what's already been invested? Probably not. These investments are worthy of your consideration when determining how you will support these initiatives in the future. 2. When you're in the investment valley of death Morbid name aside, this is the stage of funding for any start up or new project where there's a big initial investment and no profit. While an ongoing assessment of continued investment during this period is essential, it's usually the grit and perseverance of the entrepreneur that determines success (this is the stage I'm at for my business and I'm looking forward to the other side) and the time to question investment is not when you're in the initial phase of executing your business plan. 3. When the sunk costs are investments in people There have been a few occasions in my career where I canceled training for someone on my team, often having already paid (sunk) the full cost of their training, just to free them up to help hit a monthly or quarterly target. This was a huge mistake. From an economic perspective, training costs can easily fall into the sunk cost category when business needs change. However, I've learned the hard way that the best investment you can make is in your people. It's the gift that keeps on giving and the benefits are much more diverse than just an economic outcome. In most cases, sunk costs are irrelevant when making decisions about the future…but not always. Just ask my daughter! (Maybe ask her in a few weeks. Let's get through this holiday season first). References: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2750897/ Did you enjoy this post? Please like and share! I just finished re-reading Thinking, Fast and Slow by Daniel Kahneman and the timing couldn't be more perfect. Today wraps up the busiest shopping days of the year (Black Friday and Cyber Monday) and there are so many lessons in this book about human behavior that can be extracted and applied to better understand why it is we feel so compelled not to miss out on deep discounts and VIP-just-for-you promotions.

For me, there's one lesson that stands out above all others as it is so often encountered when running a business: the lengths we'll go to avoid a loss. This aversion to loss causes us to buy things we don't need because of a perceived loss if we don't. And it influences decisions we make in the pursuit of results which are heavily biased toward how much time or money has been spent instead of how much will be spent. Here are the 4 tips to tame your loss aversion:

Loss aversion and sunk costs - the chicken and the egg As Kahneman points out in his book, any organism is well served with the continued gift of life when perceived threats are given more urgency than an opportunity to benefit. The hunter stalking a gazelle (gain) on the plains of Africa needed to likewise keep an eye open for lions lurking in the bushes lest he is what's for dinner tonight. This same response to a threat pops up in business when we come face-to-face with a potential loss. Think about it. When your reputation is on the line, and you've invested tens of thousands (or more) of dollars into a new project or idea, the last thing you want to do is to admit that you’re wrong or cut your losses. It's easier to bury your head in the sand and face reality after you've burned out and have no hope of recovering your continued investment, right? As a manager, you're probably all too familiar with sunk costs, but for those of us a little rusty on the subject, let's take a minute to refresh what is meant by sunk costs and loss aversion. A sunk cost is any cost that has already been paid with no possibility of recovery. Sunk costs should have no impact on future decisions. For example, salaries, leases, research and development investment, and advertising expenses often fall into the sunk cost category as these costs cannot (usually) be recovered. The value of dilapidated assets like the machine in the image at the top of this article can also be sunk costs. Even though it may have cost $200k new and had $100k in repairs over its lifetime, a contractor should never consider these costs when determining whether or not to buy a new machine for an upcoming project. Loss aversion refers to the disproportionate pain we feel from a loss versus the pleasure we receive from an equivalent gain. This is why losing $10 out of your pocket can ruin your day, while finding a $10 bill on the ground brings just a short burst of satisfaction. Loss aversion is how we generally respond to sunk costs and this behavior can greatly influence how you make less than ideal decisions, and take a long time to do so. In fact, downright bad decisions are often made when you place too much weight on how much time and money has already been invested in an idea (project, customer, or employee) and not enough emphasis on how that time or money should best be used in the future. Black Friday - loss aversion equals more AirPods Getting back to Black Friday. Retailers and marketers do a compelling job convincing us that a failure to buy causes some sort of a loss. By using time-limited offers, limited availability, and steep discounts, retailers guide people into thinking that an economic loss is imminent if they don’t purchase now. Our brain is telling us that to miss out on a savings is tantamount to a "loss", even though we could probably "gain" more by simply choosing not to buy or waiting until the items we really need go on sale again in the future. As I write this article, an email just popped up in my inbox from a big box retailer advertising Apple AirPods at their lowest price EVER via an exclusive discount, available only to me for the next 2 hours. Talk about piling on loss aversion! Well done BB. This fear of missing out can be a far greater motivator than never having known about the deal in the first place. That’s what marketers are counting on. Lessons from a dealership - my experience in loss aversion Finishing Kahneman's book and reflecting on how his lessons in behavioral economics apply to Black Friday got me to thinking about my own experience running a large heavy equipment dealership and how loss aversion can have a profound impact not just on the results of the dealership, but on the life of the general manager. The aversion to loss is particularly salient in the dealership environment with respect to sunk costs in large part because of the nature of how dealerships operate. In the heavy equipment world, uptime is king (or queen). When a customer calls for a part, needs a service, or is looking to buy a machine, it's the job of everyone in the dealership to respond to these requests, and fast. While this energetic environment can be exciting and sure makes the day pass quickly, it can also contribute to rapid-fire decision-making where managers rarely have the time to consistently make well-informed decisions. As a result, this often means that decisions are heavily biased toward loss aversion. Here are a few examples where it's easy to hold on to sunk costs when you're averse to a perceived loss of time or money:

I've been there. In running a large heavy equipment dealership, I've experienced first-hand the stubborn aversion to loss when reflecting on sunk costs. Cutting your losses is never an easy decision to make, but with a few simple guidelines, you can become much better at identifying when you should pursue the future benefit and not focus on how much is already invested. It’s not all bad - loss aversion helps you persevere Some loss aversion is a good thing. Successful entrepreneurs know how to persevere through adversity, even when it seems like you are throwing good money after bad, to pursue a goal. This perseverance is a big differentiator between those that succeed and those that don't. Alternatively, some of the most successful entrepreneurs are those who are more apt to recognize that taking a small loss now on a failing project can lead to big returns down the road when their resources are better allocated. Step off the escalator of commitment The more you commit, the more likely you are to keep committing. Here are 4 tips to help you step off the escalator of commitment and to only continue investing your time and money when it makes sense to do so:

Adjusting your bias toward loss aversion can be tough. The key is to recognize that it's natural to feel this way and that it's a perfectly acceptable response and good business practice to accept a loss and move on when there are better uses of your time and money. Looks like I've spent too much time writing as I missed out on the once-in-a-lifetime discount for AirPods. I guess I'll just have to stick with my wired earbuds for now! -luke |

subscribeArchives

February 2021

Categories |

RSS Feed

RSS Feed